Soybean: Prices on the rise in the new season

World production Global Soybean production for 2019/2020 season, is forecast at 337.70 Mio Tons, -5.7% compared to the 2018/2019 season, but it is still slightly above the level of the previous forecast. Soybean total use is continuously growing, and given the lower expected production, ending stocks should reach 96.67 Mio Tons (-12,34%). Soybean production in Brazil, expected to be the world’s main producer in the 2019/2020 season, should reach 123 Mio Tons (+5.1% compared to 2018/2019 season). United States’ production…

World production Global Soybean production for 2019/2020 season, is forecast at 337.70 Mio Tons, -5.7% compared to the 2018/2019 season, but it is still slightly above the level of the previous forecast. Soybean total use is continuously growing, and given the lower expected production, ending stocks should reach 96.67 Mio Tons (-12,34%). Soybean production in Brazil, expected to be the world’s main producer in the 2019/2020 season, should reach 123 Mio Tons (+5.1% compared to 2018/2019 season). United States’ production…

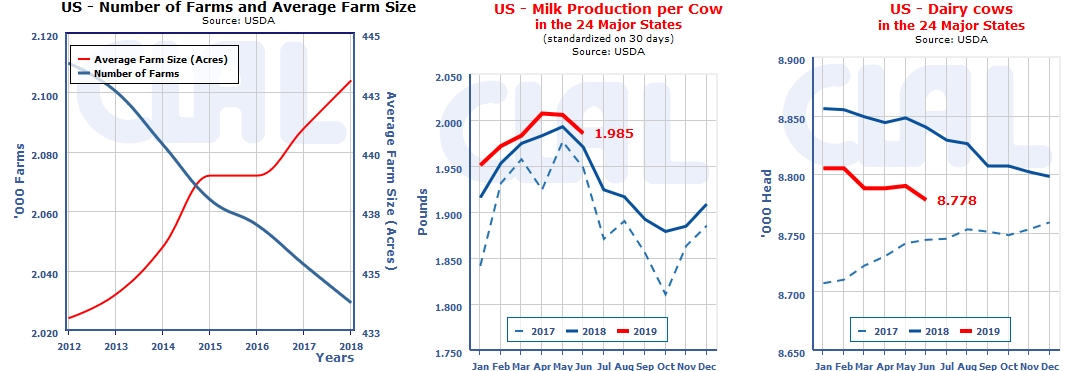

Fewer farms and higher yields per cow: the trends in the U.S.

The number of farms in the United States continues to shrink, while the farm size is becoming larger. The number of farms in the United States for 2018 is 2,029,200, down 12,800 farms from 2017 and down 70,100 from 2013. Analyzing the data collected by the Department of Agriculture of the United States of America (USDA) it also comes to…

The number of farms in the United States continues to shrink, while the farm size is becoming larger. The number of farms in the United States for 2018 is 2,029,200, down 12,800 farms from 2017 and down 70,100 from 2013. Analyzing the data collected by the Department of Agriculture of the United States of America (USDA) it also comes to…