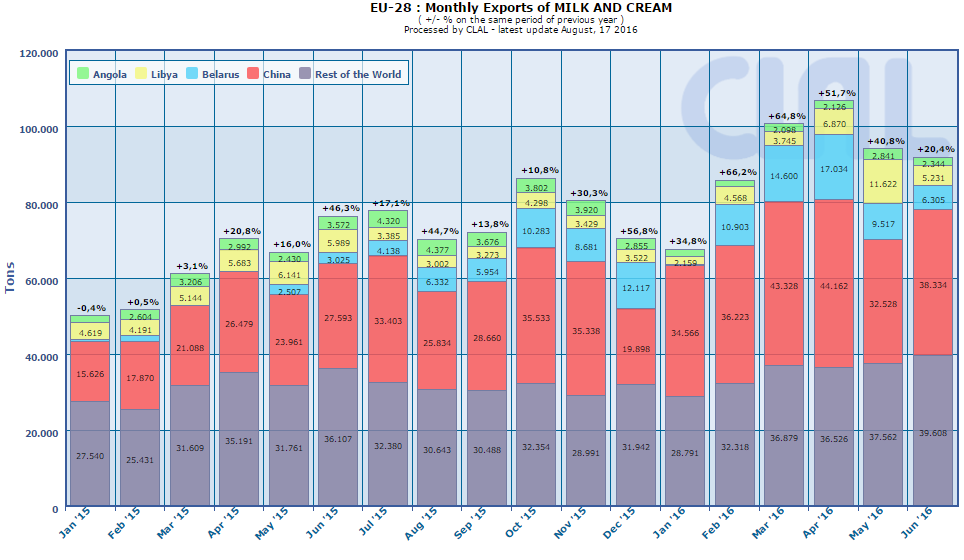

During first half of 2016, EU milk and cream exports increased by 45% (compared to Jan-Jun 2015).

Starting from May 2015, Belarus has become a major destination for these products: during first half of 2016 its import volumes were more than 6 times bigger than the year before. Belarus ranked second among the main importers of milk and cream from EU, with a share of 11%, while China ranked first.

EU-28 exports in June 2016 compared to June 2015 increased in volumes for:

- Infant milk formula (+26.8%)

- Milk and cream (+20.4%)

- Cheese (+11.8%)

- Butter (+5.7%)

- Whey Powder (+4.4%)

- WMP (+1.4%)

decreased for:

- SMP (-24.1%)

From January to June 2016 y-o-y the exports growth accounted for 7% of the increase in milk deliveries. In fact:

- EU milk deliveries increased by 3,52% (2.707.469 Tons);

- Extra-EU exports of cheese, milk powders, butter, condensed milk, liquid milk, cream and yogurt in “milk equivalent”increased by 1,93% (186.268 Tons).

The value of exports was 6.864 Mio €; the value of imports was 385 Mio €, so the commercial balance is positive (trade surplus: 6.479 Mio €)

The main regions importing European dairy products (cheese, milk powders, butter, condensed milk, liquid milk, cream and yogurt) were:

- Africa import, accounting for 24% of market share, decreased by 13.8%

- Asia – South East import, accounting for 30% of market share, increased by 8%

- Asia – Middle East import, accounting for 20% of market share, increased by 10.4%

- North America import, accounting for 7% of market share, increased by 7.2%

- Europe (Others – extra EU) import, accounting for 7% of market share, increased by 7.8%.

| EU-28: dairy products Export year-to-date (June) | |||||||||||||||||||||||||||||||||||||

| QUANTITY (Tons) | VALUE (’000 EUR) | ||||||||||||||||||||||||||||||||||||

| 2015 | 2016 | ± on 2015 | 2015 | 2016 | ± on 2015 | ||||||||||||||||||||||||||||||||

| Infant milk formula | 209.421 | 231.949 | +10,8% | 1.887.936 | 1.934.801 | +2,5% | |||||||||||||||||||||||||||||||

| Cheese | 343.105 | 392.115 | +14,3% | 1.690.734 | 1.747.599 | +3,4% | |||||||||||||||||||||||||||||||

| SMP | 359.395 | 310.214 | -13,7% | 816.479 | 604.542 | -26,0% | |||||||||||||||||||||||||||||||

| WMP | 199.555 | 205.372 | +2,9% | 649.061 | 593.597 | -8,5% | |||||||||||||||||||||||||||||||

| Butter | 93.494 | 124.845 | +33,5% | 372.084 | 457.294 | +22,9% | |||||||||||||||||||||||||||||||

| Milk and cream | 376.266 | 546.603 | +45,3% | 326.194 | 416.406 | +27,7% | |||||||||||||||||||||||||||||||

| of which: | |||||||||||||||||||||||||||||||||||||

| - Milk | 316.680 | 471.159 | +48,8% | 195.834 | 254.329 | +29,9% | |||||||||||||||||||||||||||||||

| - Cream | 59.586 | 75.445 | +26,6 | 130.360 | 162.077 | +24,3% | |||||||||||||||||||||||||||||||

| Whey Powder | 306.619 | 318.575 | +3,9% | 462.747 | 402.899 | -12,9% | |||||||||||||||||||||||||||||||

| Condensed Milk | 171.406 | 135.556 | -20,9% | 299.394 | 224.748 | -24,9% | |||||||||||||||||||||||||||||||

| Yogurt and buttermilk | 71.216 | 84.430 | +18,6% | 144.137 | 152.896 | +6,1% | |||||||||||||||||||||||||||||||

| Caseinates | 20.619 | 44.163 | +114,2% | 136.362 | 122.011 | -10,5% | |||||||||||||||||||||||||||||||

| Casein | 19.388 | 18.657 | -3,8% | 132.206 | 101.639 | -23,1% | |||||||||||||||||||||||||||||||

| Lactose Pharmaceutical | 82.878 | 75.958 | -8,3% | 105.421 | 87.565 | -16,9% | |||||||||||||||||||||||||||||||

| Other products* | 7.827 | 6.582 | -15,9% | 38.841 | 18.184 | -53,2% | |||||||||||||||||||||||||||||||

| TOTAL EXPORT | 2.261.188 | 2.495.019 | +10,3% | 7.061.596 | 6.864.182 | -2,8% | |||||||||||||||||||||||||||||||

|

* Other products: MPC prot.cont. >85%, Lactose edible Data processed by Clal based on GTIS source. |

|||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||

|

EU-28: MILK AND CREAM EXPORT Main IMPORTERS of 2016 Period: January-June |

|||||

| Ton | Share 2016 |

2014 | 2015 | 2016 | % on 2015 |

| TOTAL | 328.952 | 376.266 | 546.603 | +45% | |

| China | 42% | 106.489 | 132.616 | 229.141 | +73% |

| Belarus | 11% | 303 | 7.666 | 58.552 | +664% |

| Libya | 6% | 24.091 | 31.766 | 34.195 | +8% |

| Mauritania | 3% | 15.219 | 17.464 | 17.434 | -0% |

| Switzerland | 2% | 12.490 | 14.471 | 13.624 | -6% |

Do you need additional information on dairy Import/Export? Subscribe to the Dairy World Trade area on CLAL.it

Leave a Reply

You must be registered and logged in to post a comment.