Period: March 6 – 31, 2017

Argentina

- Milk production: is improving thanks to the favorable weather conditions that prevailed in recently wet dairy areas, helping to alleviate wetness on several dairy farms.

- Weather situation: the drier, sunny autumn climate benefited late-season growth of corn and soybeans.

- Overall market situation: one of the main dairy cooperatives closed some processing plants due to financial problems. Milk volumes are sufficient to process cheese, but are less than adequate to produce milk powders. Demands for cream based products are improving as the fall holidays approaches. However, cream supplies are seasonally tight. Thus, premiums for milk fat remain high.

Uruguay

- Milk production: is improving slightly, as early autumn temperatures are becoming comfortable for dairy herds. Milk butterfat and protein component levels remain steady.

- Overall market situation: requests for cream from butter and milk caramel manufacturers continue to be strong on a bullish market.

Brazil

- Milk production: output is mostly variable, depending of the region and mixed weather conditions. In some dairy basins, cow productivity remains depressed due to the effects of drought prolongation, which is decreasing the quality and availability of pastures and fodders.

- Overall market situation: milk supplies are well below manufacturing needs. Fluid/UHT milk requests from several private and public market channels remain strong. Cheese processors continue reporting a reduction in production and high inventory levels. Subsequently, whey supply is low, but demand is stable.

MILK DELIVERIES

- Argentina: -12.62% (2016 year-over-year)

- Uruguay: -1.81% (Jan-Feb 2017 y-o-y)

- Brazil: -3.68% (2016 y-o-y)

- Chile: +0.71% (Jan-Feb 2017 y-o-y)

SMP prices for 1,25% butterfat: 2,500 – 2,900 USD/MT, F.O.B. port (about 2,301 – 2,669 €/MT).

Prices shifted higher on very light trading, then lower in recent weeks, following downward movements at the GlobalDairyTrade. SMP supply is well below current buyers’ needs. SMP export pricing from U.S. to Brazil is competitive, even with the 28% common external tariff (CET) paid to Mercosur.

WMP prices for 26% butterfat: 3,000 – 3,500 USD/MT, F.O.B. port (about 2,761 – 3,222 €/MT).

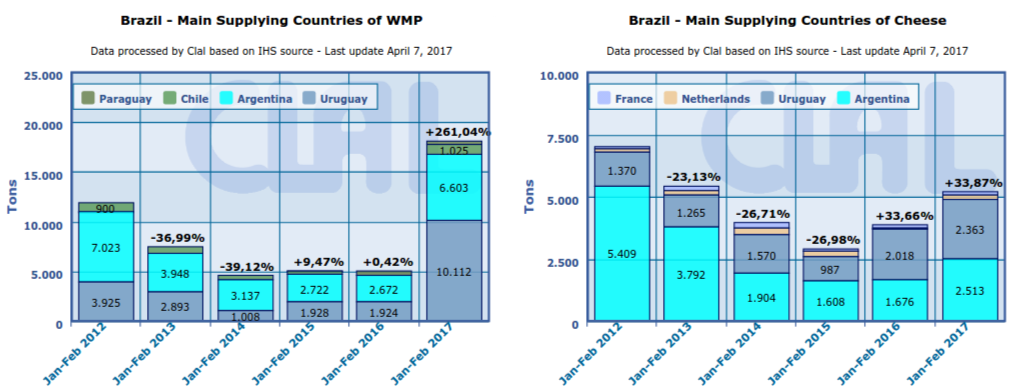

Prices shifted higher, thanks to the lower WMP production and recent upward movements at the GDT. In Brazil, demand for WMP from the food processing industry is robust, but WMP supply is less than adequate to cover buyers’ needs. The strong Brazilian currency is making WMP imports from other countries within the Mercosur bloc more accessible. However, regional WMP trading activity is irregular, driven by supply availability.

Overall, milk supplies in South America, and production of derivatives as a consequence, are below buyers’ needs.

Source: USDA summarized by the CLAL Team

Note: assessments about market trend are expressed in US$

More informations about dairy market in Argentina, Brazil and Chile are available on CLAL.it

Leave a Reply

You must be registered and logged in to post a comment.