Period: November 14 – 25, 2016

Argentina

- Milk production: is seasonally trending lower, but still in good balance with processing needs.

- Milk producers: pasture conditions are good in the main dairy basins of Córdoba, Santa Fe, and Buenos Aires. In October, farmgate milk prices were $4.43 Argentine pesos (ARS) per liter (about 26.45€/100lt or 0.29 USD/liter or $12.91 USD/cwt), up 1% from last month and 65% above the previous year.

- Overall market situation: fluid milk demand is stable. Bottled milk sales into governmental food aid programs are active.

Uruguay

- Milk production: is seasonally trending lower, but well in balance with manufacturing needs.

- Overall market situation: bottled milk demand is good, following seasonal trends. There is surplus milk clearing into dryers. WMP processing is very active.

Brazil

- Milk production: is steady, following seasonal patterns.

- Weather situation: rains in the main dairy states are helping to ease the drought and improving pasture quality.

- Overall market situation: spot milk prices in Brazil slightly fell to $1.09 Brazilian reals (BRL) per liter (about 30.79€/100lt or 0.33 USD/liter). In late November, the average wholesale price for UHT milk was 1.95 BRL per liter (about 54.08€/100lt or 0.58 USD/liter). Fluid and UHT milk requests from many retail outlets are robust. With the summer season approaching, the demand for ice cream is improving. Food processors’ demands for dry ingredients continue to be strong.

MILK DELIVERIES

- Argentina: -11.48% (Jan-Oct 2016 year-over-year)

- Uruguay: -11.37% (Jan-Oct 2016 y-o-y)

- Brazil: -6.37% (Jan-Jun 2016 y-o-y)

- Chile: -1.65% (Jan-Sep 2016 y-o-y)

WMP prices for 26% butterfat: 3,750 – 3,450 USD/MT, F.O.B. port (about 2,547 – 3,195 €/MT).

Prices shifted higher mainly influenced by the GDT auction. The bottom price is based on export trades outside the Mercosur bloc, while the top is centered on trades within Mercosur, principally exports to Brazil. Production of WMP is very active throughout the region. In Argentina and Uruguay, inventories are in balance with buyers/end users’ needs. However, Brazil continues with the need to import since WMP supplies are tight. At this point, Uruguay continues to be the major WMP exporter to Brazil.

A 6.4 magnitude earthquake hit Argentina, but there are no reported damages to the country’s dairy industry.

Source: USDA summarized by the CLAL Team

Note: assessments about market trend are expressed in US$

More informations about dairy market in Argentina, Brazil and Chile are available on CLAL.it

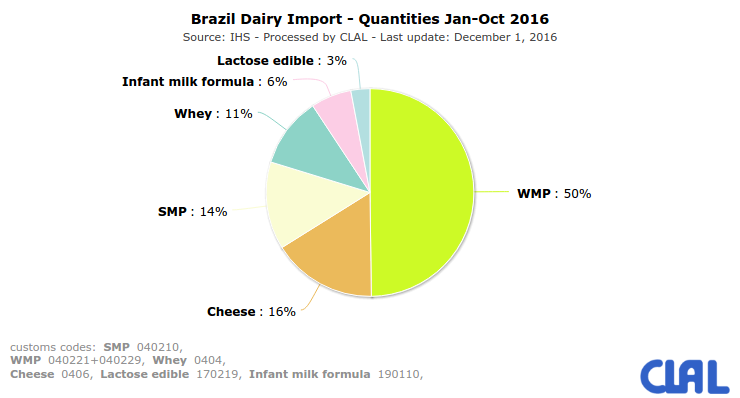

[…] LIVRAISONS DE LAIT (janvier-octobre 2016 par rapport à l'année précédente) : Argentine: -11,48% Uruguay: -11,37%Brésil: -6,37% Chili: -1,65% + camembert Importations brésiliennes ventilées par produit laitier […]