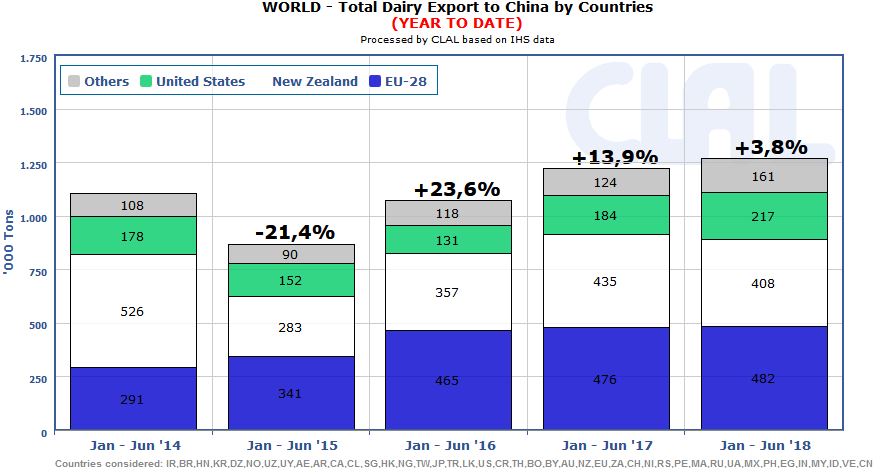

After the trade tensions with the U.S., China has stopped all official updates of dairy import data. On the basis of the figures provided by the exporting countries, we can still outline a positive trend in Chinese imports.

Dairy Export

to China

+3.8%in volume

Jan-Jun 2018

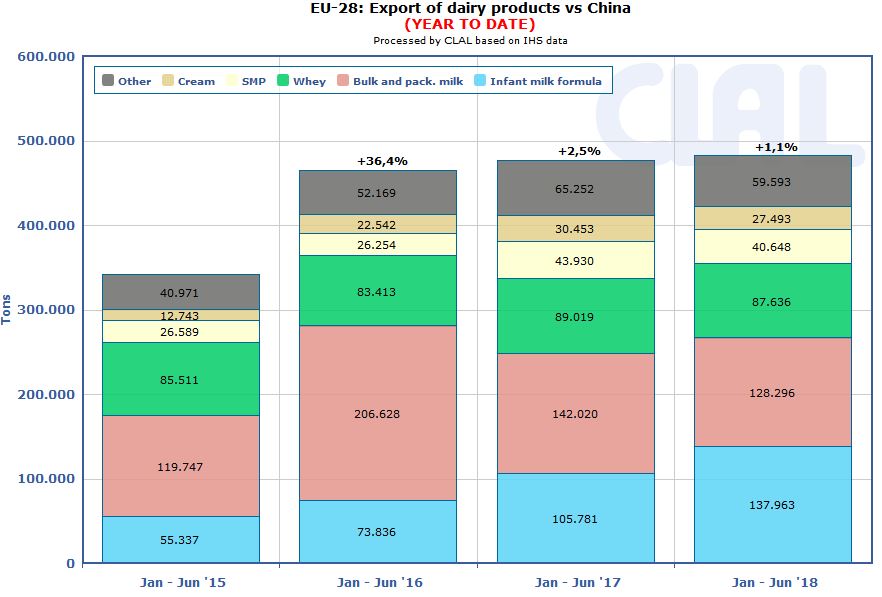

The EU is approaching the milestone of 500 thousand tons exported in the first half of 2018, with good performance of infant milk formula (138 thousand tons, +30.4%), which exceeds packaged milk and becomes the main EU dairy product exported to China.

On the other hand, EU slowed the exports of Whey (-1.6%), SMP (-7.5%) and Cream (-9.7%), compared to the first six months of 2017.

EU Cheese export to China grew (+7.8%), even if the volumes are modest: 8,755 tons, of which 1,696 from Italy (from January to May).

The United States gain ground in China: +17.7% with positive results for Cheese export (+34%), which exceeds 8 thousand tons, while SMP export drops, recording -25% compared with the volumes exported in the first half of 2017.

The tariffs knot, however, is far from being untied. How will trade evolve?