Dairy Export

to China

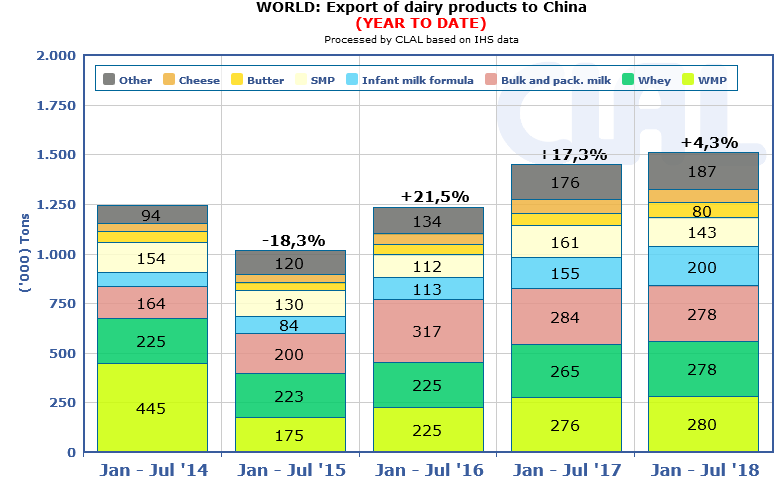

+4.3%in volume

Jan-Jul 2018

The best performance is given to Infant milk formula, Butter and Whey, while SMP and packaged milk lose ground.

In a context in which the reasons of the slowdown in Chinese imports are probably due to a lower liveliness of the economy (GDP should grow “only” by 6.4% this year and +6.2% in 2019, thus highlighting a downward trend, however positive), the European Union increases exports to China between January and July 2018 only by 0.5%, compared to 6% last year.

Certainly the quality of European products is the basis for increases in Infant milk formula (+29.8%), Cheese (+5.7%) and Whey (+3.7%) y-o-y.

The EU-28 export to China trend of packaged milk, milk powders, cream, butter and yogurt is negative.

To what extent does the slowdown in Chinese demand depend on the slowdown in GDP, internal policies for the relaunch of the livestock industry or the situation of duties (see chart below)?