Global production for the season 2018-19 is projected higher both for Corn and Soybean, respectively at 1054.3 Mio t (+0.2% from June outlook) and 359.5 Mio t (+1.2%).

Corn production increased in the U.S. (361.5 Mio t, +1.4%), on higher planted and harvested areas, and EU-28 (61.5 Mio t, +0.8%). These increases more than offset the reduction expected for Canada and Russia, due to lower area and yield.

Soybean production is raised in the main producing countries: respectively +0.7% (117.3 Mio t) and +2.1% (120.5 Mio t) in the US and Brazil, both on higher harvested area, +1.8% in Argentina (57 Mio t) and +2.8% in China (14.5 Mio t).

-10.9%

U.S. Soybean Export (Forecast 2018-19)

Corn global trade outlook is for a reduction in export from Russia, more than offset by increased export for the United States (56.5 Mio t, +6%) based on the expectations of lower competition from Argentina and Brazil.

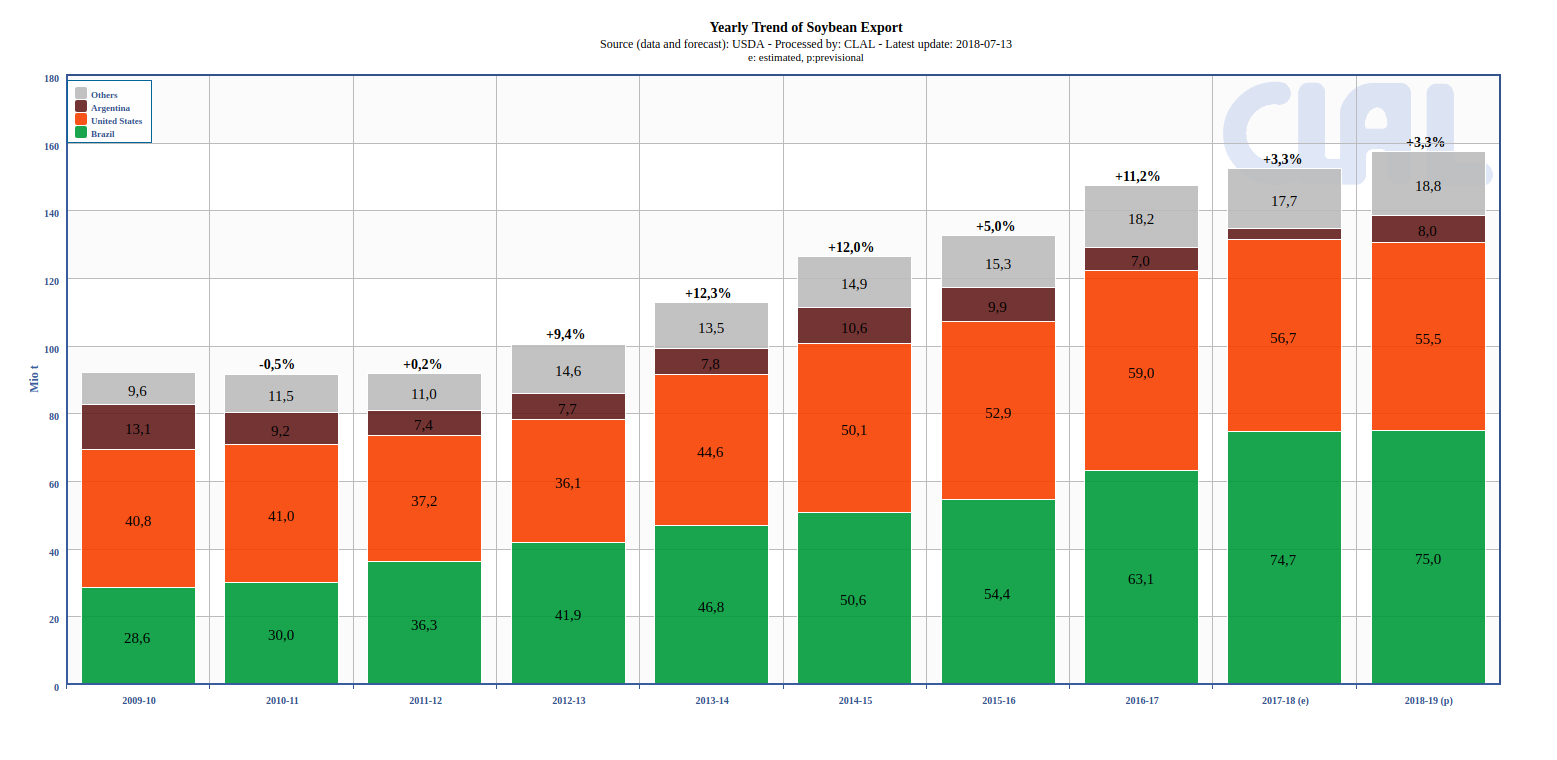

Soybean export is reduced for the U.S. (55.5 Mio t, -10.9%), reflecting the impact of China’s import duties. Despite losing market share in China, Soybean exports from the U.S. are supported in other markets, as lower prices increase demand and market share.

This decrease is partly offset by an increase for Brazil (75 Mio t, +2.9%), where planted area is expected to expand with higher prices resulting from increased trade with China.

+12.9%

Global Soybean Stocks (Forecast 2018-19)

Global Corn ending stocks are lowered from last month (152 Mio t, -1.8%), with the largest declines for China, EU-28, Mexico and the U.S., due to a higher domestic consumption.

On the contrary, Soybean stocks are forecasted higher at 98.3 Mio t (+12.9%), mainly reflecting the increase in the United States (15.8 Mio t, +50.6%).

The tariff that China imposed on U.S. Soybean is expected to cause higher prices for Soybeans in China and slower protein meal consumption growth. Lower demand and a year-over-year drawdown in stocks for China are forecast to result in reduced crush and a decline for imports to 95 Mio t.

Source: USDA