Period: October 26 – November 6, 2020

In Australia there is optimism among Milk producers. Pastures are better than in the previous year and many producers are able to grow more hay or to buy it at lower prices.

Australian exporters are trying to develop partnerships with other countries in South-East Asia, such as Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, with the aim of reducing the dominance of China as the main export destination and increasing the stability and diversity of its exports.

New Zealand+1,7% milk production September 2020 y-o-y

In New Zealand, Milk production in September increased by +1.7% compared to September 2019. The overall change in milk production in the period June – September 2020 is +2.9% compared to the same period of the previous year.

Dry pastures and a shortage of seasonal workers on dairy farms could adversely affect milk production.

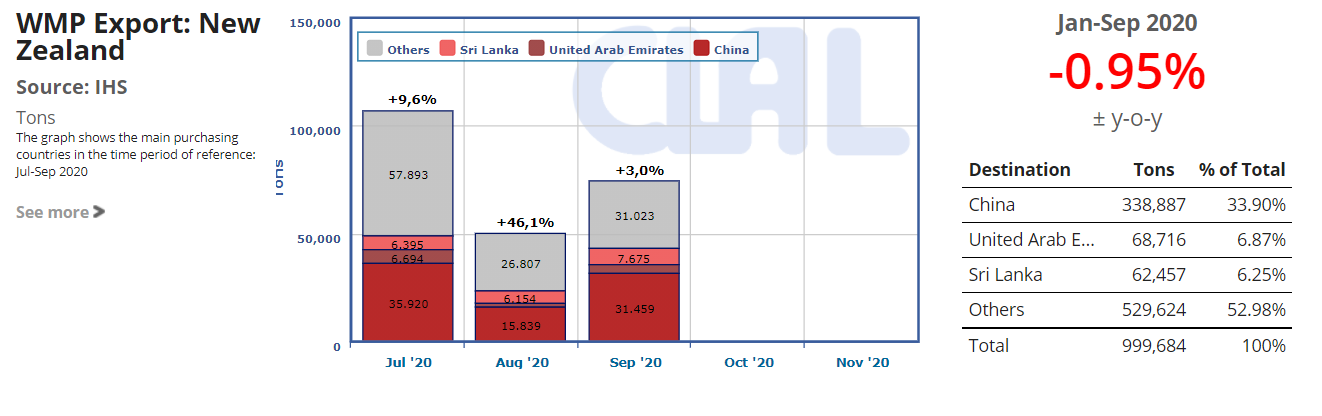

New Zealand exporters of dairy products are worried that the current market situation, characterised by the growth of Covid-19 issues, may continue to slow down the purchases of some buyers.

Fonterra has recently signed a distribution contract with the large U.S. dairy cooperative Land O’Lakes, to help move New Zealand dairy products to US foodservice customers.

Price of Dairy Commodities

In Oceania, the price of Butter rose, approaching the price levels of European butter. Several Buyers, having need to buy short-term stocks, conduct buying activity on the spot market. Butter production remains active.

The price of Cheddar Cheese decreased slightly. Despite this, producers claim that cheese remains the more profitable dairy product. The main goal is to increase export sales.

Milk Powder prices decreased. The reasons for the decrease are the slowdown in the export of SMP and WMP to China and other countries in Southeast Asia, and the uncertainty of the market given by the Covid-19 situation in Europe and the presidential elections in the USA.

Furthermore, recent exports of SMP by India have increased competition.

Although production of SMP and WMP remains active, it is likely that with these price levels, the milk in surplus will be used for more profitable dairy products.

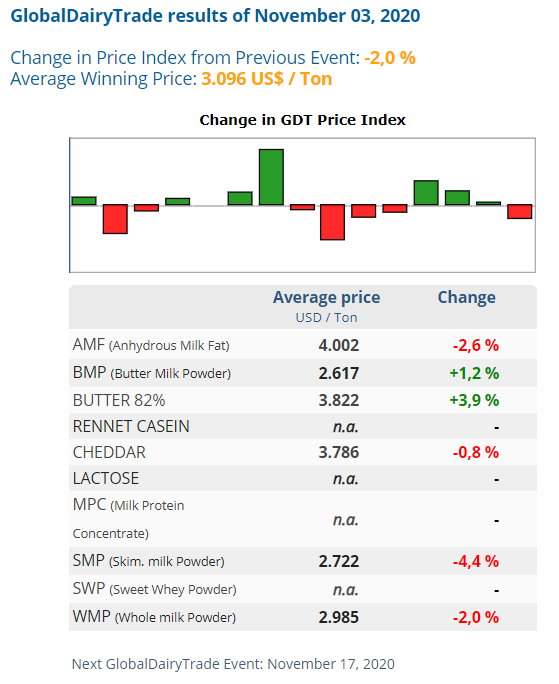

The event of the Global Dairy Trade of November 3, reflects the market situation, recording an overall change in the average price of -2,0%.

There is an increase in the average price for Butter (+3.9%), while Cheddar and Milk Powders are down, respectively -0.8% for Cheddar, -4.4% for SMP and -2.2% for WMP.

– Dairy season: July, 1st – June, 30th (Australia), June, 1st – May, 31st (New Zealand);

– Source: USDA summarized by the CLAL Team