Period: February 17 – 28, 2020

In Australia, January – December 2019 milk production decreased 4.3% from 2018. July – January milk production is lower of 3.7% compared to the same period of last year.

Considering the fire and drought impacts, as well as other indicators, dairy experts in Australia expect seasonal milk production to finish the production year below last season volumes. Weaker milk production is leading to dairy plant closures.

In Western Australia a combination of production costs and what is perceived as weak milk pay prices are resulting in more herd culling or outright herd sales for slaughter or export.

New Zealand-0.7% milk production January 2020 y-o-y

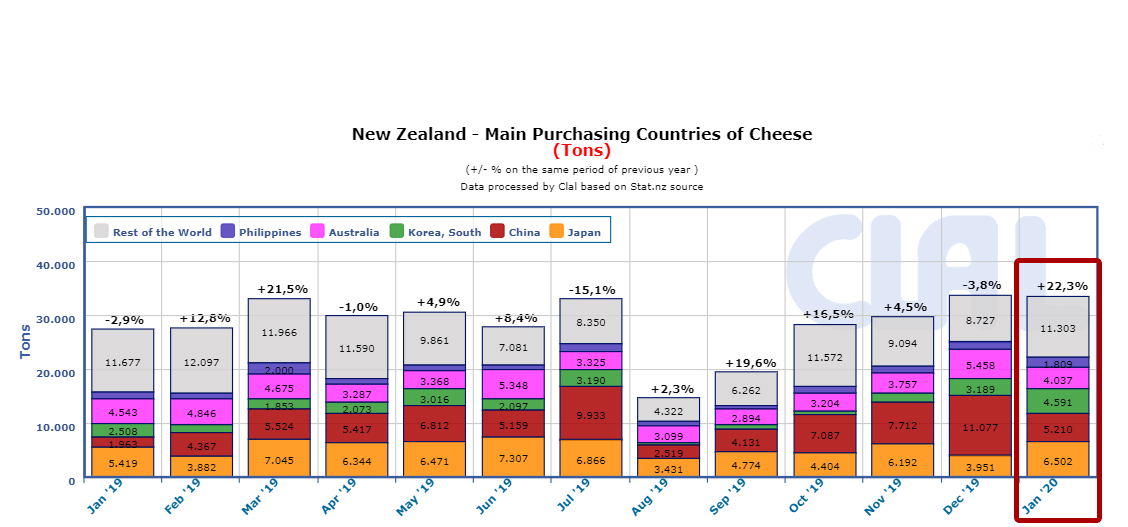

In New Zealand a lower milk production is reported, which is helping to support farm-gate milk prices while the demand from China is lower, due to the impact of coronavirus.

Dry weather in the North and flooding in the South are impacting milk production. The government has formally declared drought conditions in some areas of the country, even well-prepared dairy producers are vulnerable to overwhelmingly prolonged periods of inadequate rain.

The quarantines in China have resulted in a big decline in eating out and in store food shopping in affected areas. Dairy processing is reduced and internal logistics have slowed, especially trucking.This virus confirms itself as a major unknown risk factor.

Prices of Dairy Commodities

Oceania Butter prices moved lower, mainly because of two factors. First, the lower prices in Western Europe are leading buyers on sourcing from there. Second, some buyers already stocked are more comfortable in slowing purchases in Oceania. This is occurring even as Oceania continues to experience seasonally declining milk production, leading to declining butter churning. Supplies are tight in Australia.

SMP prices are steady. Most of Oceania SMP customers are contracted. There are growing stocks of SMP in Western Europe, where the SMP price range is lower than in Oceania. The shipments to China are slowing resulting from Coronavirus side effects.

Cheddar prices in Oceania are stronger. While China is a customer for cheddar from New Zealand, the array of other export destinations keeps cheddar exports moving. Tight supplies in Australia have limited volumes available for export. Cheddar production is expected to slow down in coming months, so there is some confidence in ongoing pricing holding some strength.

WMP prices in Oceania are lower. There are more uncommitted stocks available, hit by slowing exports to China attributed to coronavirus. Uncertainty over the pacing of possible future contracting is also a factor weighing on prices.

Even more uncertainty is once normality returns, will stocks move to China to make up for slowed current shipments?

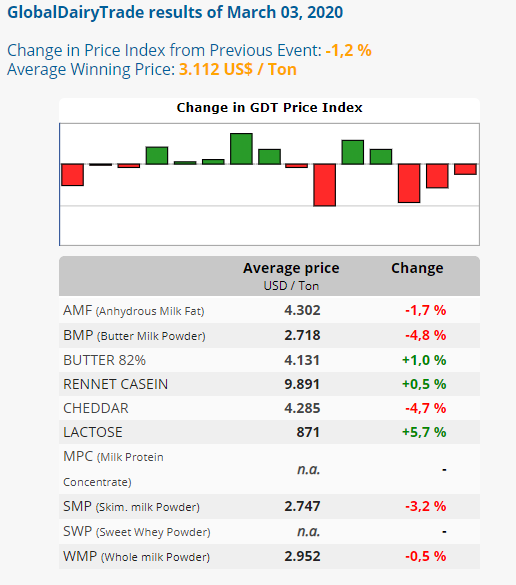

The Global Dairy Trade Event of February 4 has recorded an overall variation of -1.2% compared to the previous event, confirming the decrease in prices of the dairy products.

- Assessments about market trend are expressed in US$;

– Dairy season: July, 1st – June, 30th (Australia), June, 1st – May, 31st (New Zealand);

– Source: USDA summarized by the CLAL Team