Period: November 24 – December 5, 2014

AUSTRALIA

- Milk production: is beginning to trend downward, but remains above year ago levels.

- Weather situation: persistent dry conditions in some areas may accelerate the downward trend of milk production. Some badly needed rains covered some of the dairy producing areas. The rains will help pasture and forage growth, but are hampering the barley harvest.

- Milk producers: hay harvest yield is below average. Demand is strong for 2015 hay supplies with current prices steady to firm.

NEW ZEALAND

- Milk production: is moving lower with steeper declines on the South Island. Milk production is above year ago levels and manufacturers are busy processing current milk volumes.

- Milk producers: farmgate prices are lower if compared to last season, with many producers forgoing supplemental feeding. This situation may lead to a shorter season as producers may dry off cows earlier in light of the marginal returns on extended production.

MILK PRODUCTION

- New Zealand *: +4,91% (Jun-Oct 14 vs. Jun-Oct 13)

- Australia *: +3,80% (Jul-Oct 14 vs. Jul-Oct 13)

BUTTER (82%): prices moved higher; production is active with some marginal reductions in Australia as holiday cream demand is strong and restricting some cream volumes going to churns; good domestic demand in Australia is restricting supplies available for export; New Zealand supplies are readily available; demand is fairly good coming from the Middle East and Asia.

CHEDDAR CHEESE: prices moved lower; production is very active; strong domestic demand in Australia is keeping supplies tight for exports; strong competition with the other international cheddar suppliers for 2015 Japan supplies; the market has a weak undertone going into 2015, due to the readily available global supplies.

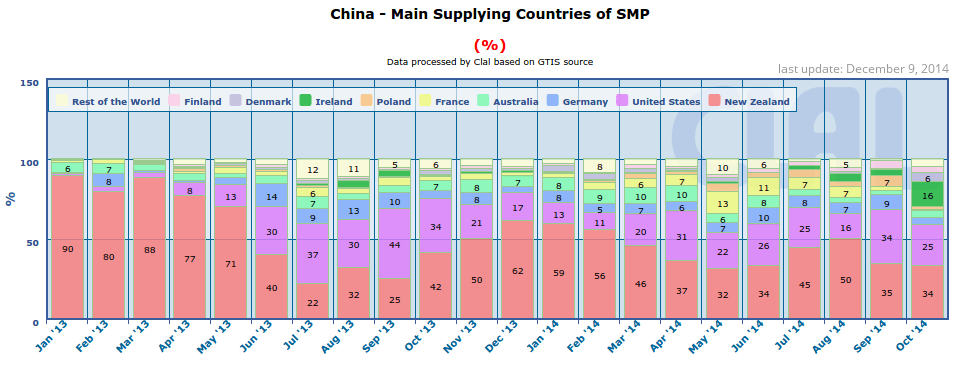

SMP: prices moved lower on the upper end of the range; production is strong and supplies are building; demand is fairly good, but there is some buyer hesitancy as increasing global supplies in the coming weeks and months may possibly lower prices; the market undertone is weak as international supplies are outstripping demand; New Zealand’s share on China’s imports of SMP declined as well as the U.S. share, but some European countries showed increases.

WMP: prices moved lower; production is active in New Zealand, but marginally reduced in Australia as some milk flows are being diverted away from WMP and into cheese, butter and SMP production; New Zealand remains the largest exporter of WMP into China, but sales to China still sluggish; some state that lower consumer prices for WMP products in China have increased sales.

The Free Trade Agreement recently signed by Australia and China will benefit infant formula manufacturers with a phase out of the current 15% tariff over the next four years.

Some New Zealand cooperatives have increased their investment in milk powder, infant formula and UHT processing and packaging. The additional investments by these cooperatives may help reduce their exposure to the more volatile bulk commodity prices.

Note: · Assessments about market trend are expressed in US$; · * Dairy season: July, 1st – June, 30th (Australia), June, 1st – May, 31st (New Zealand).

Source: USDA summarized by the CLAL Team

Leave a Reply

You must be registered and logged in to post a comment.