Period: January 9 – February 3, 2017

Argentina

- Milk production: is trending lower due to the recent floods. Some dairy operations (tambos) had to close temporarily, while others are isolated by water, as roads are impassable for milk hauling.

- Weather situation: many alfalfa crops have been ruined by thunderstorms. Warm weather returned in some areas of the main dairy basins, but muddy conditions persist, taking a toll on cows’ comfort.

- Overall market situation: operational schedules have been irregular in some cheese and yogurt processing plants. Several milk loads that were originally destined to dryers are now moving into cheese plants, normalizing production. With less cream supplies, butter output has been affected, too.

Uruguay

- Milk production: milk yields are seasonally down (summer). Milk volumes are mostly in balance with processing needs.

- Weather situation: it seems that the rains have helped alfalfa crops. There are not significant impacts to the milk output and milk hauling.

- Overall market situation: butter production remains active with good demand from the domestic market, as well as from Russia.

Brazil

- Milk production: is down, mainly impacted by high daytime temperatures.

- Weather situation: a serious water deficit in the main dairy basin is affecting fodder growth.

- Overall market situation: cheese makers are receiving moderate milk volumes, while cheese production remains active. Some cheese processors continue holding inventories, expecting higher domestic prices in the near term. Bottled milk requests are up as the new school year is starting. Production of WMP and SMP remains active with strong domestic demand.

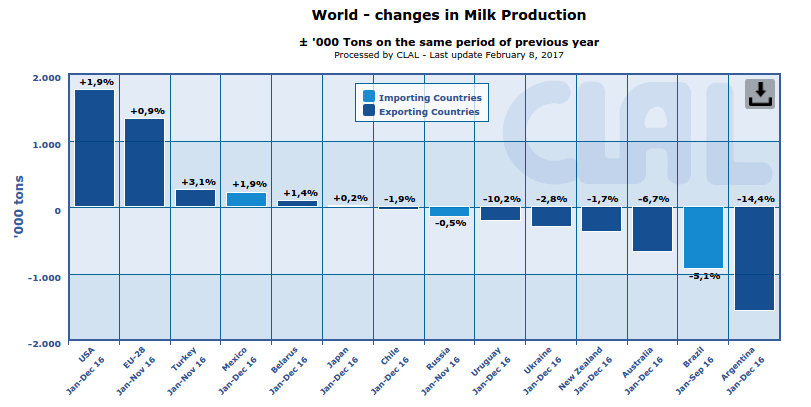

MILK DELIVERIES

- Argentina: -14.38% (2016 year-over-year)

- Uruguay: -10.15% (2016 y-o-y)

- Brazil: -5.08% (Jan-Sep 2016 y-o-y)

- Chile: -1.86% (2016 y-o-y)

SMP prices for 1,25% butterfat: 2,400 – 2,550 USD/MT, F.O.B. port (about 2,244 – 2,385 €/MT).

prices increased first, then slightly decreased on light trading. Supplies are becoming tight in Argentina, while in Brazil SMP production is active and inventories are slightly increasing, putting some pressure on SMP import prices from nearby countries.

WMP prices for 26% butterfat: 2,800 – 3,425 USD/MT, F.O.B. port (about 2,618 – 3,202 €/MT).

The bottom price of the range slightly increased. WMP production decreased in Argentina, while is stable in Uruguay. In Brazil, WMP production is active as many processors are clearing more milk into dryers, instead of using the milk for other purposes. Demand for domestic Brazilian WMP is improving. Therefore, WMP imports from Brazil are slightly lower. Brazilian processors continue building stocks, anticipating higher selling prices in the future.

During December 2016, Venezuela was removed from the Mercosur bloc, and will no longer benefit from duty free access to goods from Argentina, Uruguay, and Brazil. In the past, Venezuela has imported significant amounts of dairy products, especially from Argentina. The possible future impacts to the South American dairy industry are still uncertain.

Source: USDA summarized by the CLAL Team

Note: assessments about market trend are expressed in US$

More informations about dairy market in Argentina, Brazil and Chile are available on CLAL.it

[…] MILK DELIVERIES : Argentina: -14.38% (2016 year-over-year) Uruguay: -10.15% (2016 y-o-y) Brazil: -5.08% (Jan-Sep 2016 y-o-y) Chile: -1.86% (2016 y-o-y) […]