World Corn production expected to decrease by 1%.

World corn production for the season 2019/20 is estimated at 1111.59 Mio Tons, unchanged compared to the last outlook. The overall production is expected to decrease by 1% compared to the previous season.

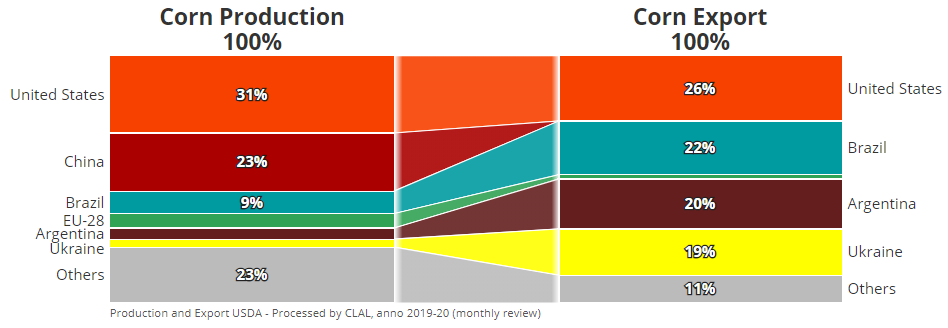

The US lower Corn production forecast (-4.5%) could limits the surplus available to the export, which is expected in significant decrease. Considering that US Mais production accounts for 31.3% of the total production, this trend could have an impact over global prices.

According to USDA data, Chinese Corn production for the season 2019/20 is projected higher by 1.3% compared to last season, reaching 260.77 Mio Tons, but still not enough to completely meet domestic demand.

In Brazil, Corn collection has been already completed for about 50% of total harvested areas. Local farmers are waiting for adequate rains, which could prevent crop loss.

Favorable climate conditions in Argentina are supporting Corn production, estimated at 50 Mio Tons for the current season, slightly decreasing compared to the excellent 2018/19 season.

Production in Ukraine, the fourth world Corn exporter, is expected to be at the same high levels of the previous season. Ukraine accounts only for the 3% of the global Corn production but it has a significant share on the global Corn export (19%).

Global Corn stocks, according to USDA data, are lowered for the third consecutive year.

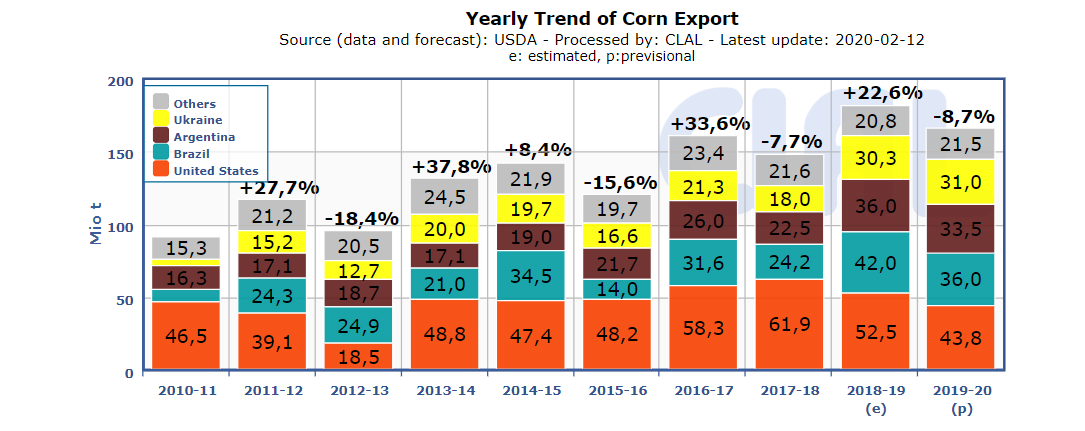

Export in decline for the main global Players

World Corn export for the season 2019/20 is expected lower compared to the last season. The main exporting countries are reducing their estimates: -16.5% for the US, -14.3% for Argentina and -6.9% for Brazil.

The delay of the brazilian second crop could affect the export of the United States. The exported volumes from the US could overcome the current estimates if the brazilian supply will not be enough to satisfy the demand from trade partners, or if the trade deal US-China will lead to higher chinese purchases.

Projections for trade flows with China are still uncertain following the current issues related to the Coronavirus outbreaks.

Market uncertainty, Futures quotes slowing down

The ongoing spread of the Coronavirus through China are generating uncertainty in the financial and commodity markets. This uncertainty is also reflected in the futures’ market, which have maintained a range between $3.95 and $4.05 from mid-December until the first outbreaks of the Coronavirus in late January. Since the emergence of the disease has begun, old crop futures continue to grind lower with July futures closing on February 25 at $3.79.

Futures highlight closed contracts with lower prices compared to the previous weeks. Considering the lower Corn production expected for the season 2019/20, it could be possible to see a market Rally on Corn quotes in the next few months