The Austral news offers the latest information on the dairy market in Oceania and South America.

Oceania: increase in exports of Fresh Cheeses to Southeast Asia

In Australia, the new dairy season will start on July 1st. The data for the first 9 months of the 2020/21 season show an increase of +0.7%, compared to the period July 2019 – March 2020, with a production in March lower than the previous year (-1.8%). Mice have overrun New South Wales. The situation comes from from heavy rain, which created bumper crops, leading to ideal conditions for mice breeding.

New Zealand

Milk production+2.4%Jun20 – Apr21

The South Island was recently hit by heavy flooding, which damaged infrastructure, fences and winter crops.

On May 26, Fonterra announced the opening Farmgate Milk Price range for the new 2021/22 New Zealand season: NZD 7.25 – 8.75 per kgMS, with an average price of NZD 8 per kgMS, +6% compared to the May forecast for the 2020/21 season.

Comparing the price of 4,71 €/kgMS to the prices of European milk is obtained:

- 32.74 €/100 kg of milk with 4.0% fat and 3.4% di protein weight/weight (ref. Germany)

(current exchange rate taken as reference: 1 NZD = 0,58837543 €).

Fonterra’s CEO expectations

In April 2021, exports of Fresh Cheeses increased significantly, both for Australia (10,026 tons, +34.7%) and New Zealand (6,486 tons, +75.1%). Southeast Asia remains the main importing region, driven by China and Japan.

In Australia, exports of SMP (19,161 tons, +58.3%) and Butter (2,671 tons, +317.6%) also increased.

The prices of the dairy commodities in Oceania decreased and the Global Dairy Trade event on June 15 confirmed this trend, recording an average price change of -1.3%. There were reductions for WMP, SMP and Butter, while the prices of AMF and Cheddar slightly increased.

South America: autumn temperatures support healthy milk production

In Argentina, the mild climate of the first four months improved the conditions of the pastures, favoring greater milk production (+4.5% compared to January-April 2020).

In April 2021, milk deliveries to Argentina (+3.5%) and Uruguay (+5.8%) increased, despite the increase in feeding costs. Chile’s milk supply slightly declined (-0.3%).

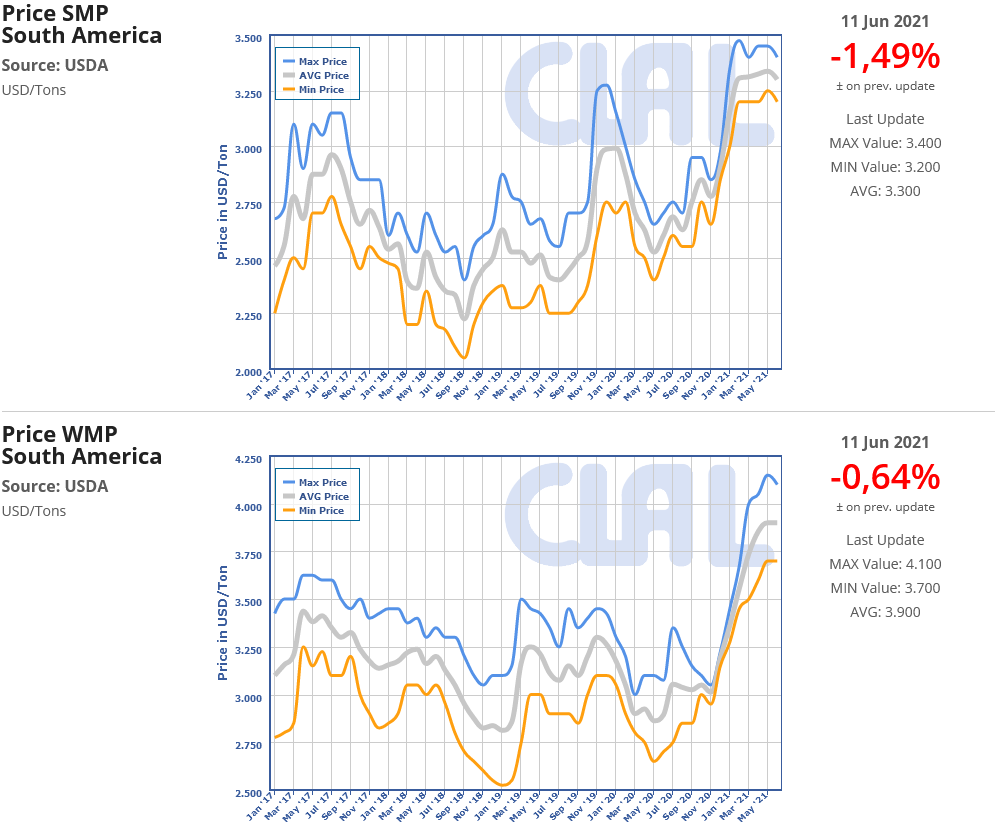

While remaining at a high level, the average prices of SMP and WMP in South America show a small decrease compared to the previous weeks, reflecting the global market trends.

Source: CLAL processing on USDA, IHS and local sources.

Note: assessments about market trend are expressed in US$