Period: June 13 – 24, 2016

AUSTRALIA

- Milk production: the 2015/2016 production season is nearing an end.

- Weather situation: recent rains have eased drought conditions.

- Milk producers: following recent rains there has been an easing of demand for fodder. Good grass feeding has now become an option in some areas. Two more factors supporting easing demand for purchased feed are: growing expectation for better crop output in the new production season and the number of cows reduced by the recent cow culling.

NEW ZEALAND

- Milk production: in May has been +3.52% above May 2015 level. Season 2015/2016 ended with a production -1.58% below previous season. The new milk producing season has now begun.

- Milk producers: farm credit availability and costs are increasingly vital to keeping many dairy producers in business until the situation resolves more favorably.

MILK PRODUCTION

- Australia *: -1.15% (Jul 15 – Apr 16 vs. Jul 14 – Apr 15)

- New Zealand *: -1.58% (Jun 15 – May 16 vs. Jun 14 – May 15)

BUTTER (82%): prices increased; they are expected to continue in coming weeks. Increasing domestic demand in Australia, coupled with butter prices strength in the EU and in the U.S., are helping strengthen prices in Oceania.

CHEDDAR CHEESE: prices increased at the lower end of the range. Profitability has been good and exports stronger. Many importers of cheddar are loyal to their sources.

SMP: prices unchanged. International competition is still strong, and with the anticipation of increasing milk volumes with the new milk producing season, markets are expecting increasing volumes of SMP to become available.

WMP: prices declined slightly. With the new milk producing season, expectations of an increasing milk supply are weighing on prices. WMP is a significant element of New Zealand dairy exports and some dairy experts are anticipating increases in pricing in late 2016.

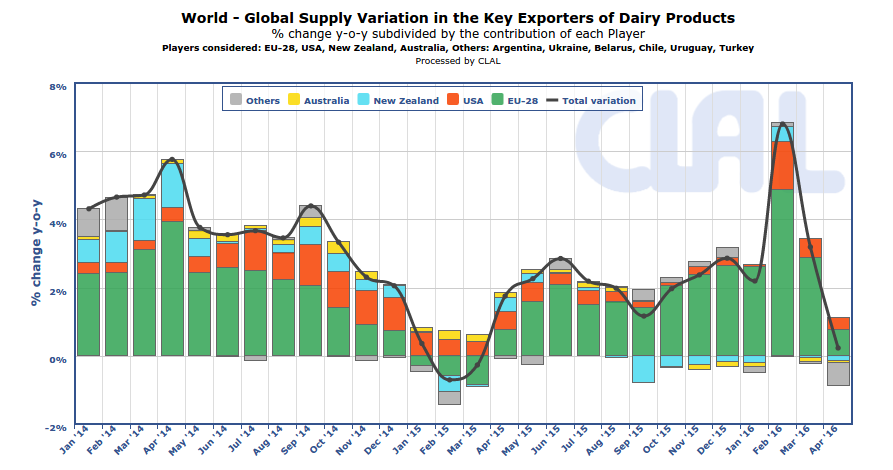

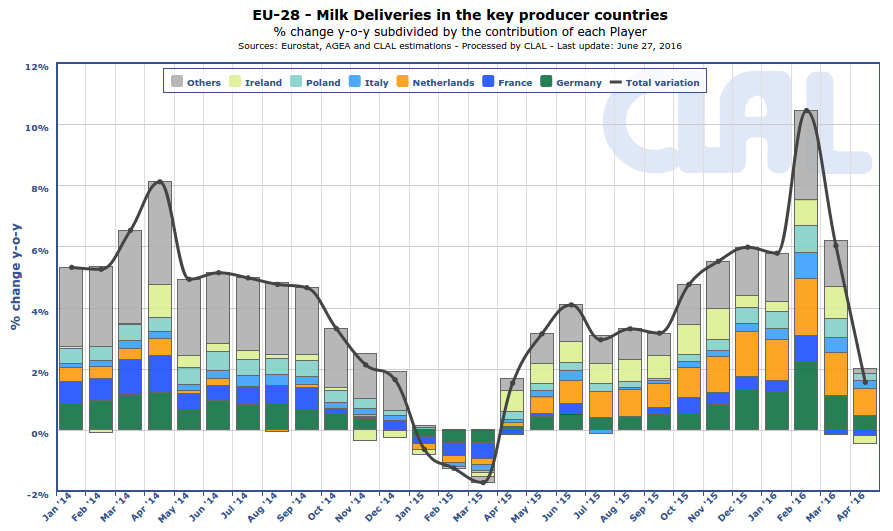

Many dairy processors in New Zealand have found it difficult to export desired volumes in the first half of 2016, due to stong post quota dairy production volumes in the EU, as well as the United States. Any hopes of recovery for the domestic dairy industry have been pushed into the second half of the year. With a relatively small population for the magnitude of the dairy industry, New Zealand is particularly export focused. Global dairy competition is quite strong. There is substantial thought that recovery in New Zealand is more tied to a slowing of EU dairy production, than anything within the control of New Zealand producers or processors.

Note: · Assessments about market trend are expressed in US$; · * Dairy season: July, 1st – June, 30th (Australia), June, 1st – May, 31st (New Zealand).

Source: USDA summarized by the CLAL Team

More informations about milk production in New Zealand and Australia are available on CLAL.it

Leave a Reply

You must be registered and logged in to post a comment.