Italy exports in November 2015 compared to November 2014 increased in volumes for SMP (+212.7%), Cheese (+18.5%) while decreased for Whey Powder (-7.2%).

Export of main cheese in November 2015 compared to November 2014 increased in volumes for Fresh cheeses incl. mozzarella, cheese and ricotta (+32.2%), Grated or powered cheeses (+28.1%), Gorgonzola (+25.1%), Grana Padano and Parmigiano Reggiano (+16.1%), Asiago, Montasio, Ragusano, Caciocavallo (+12.6%), Provolone (+11.1%) while decreased for Pecorino and Fiore Sardo (-22.9%).

The main importers in the first 11 months of 2015 (year over year) were:

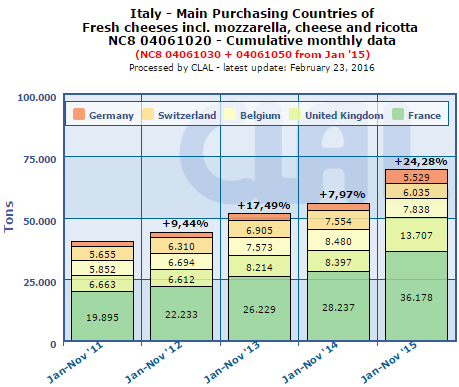

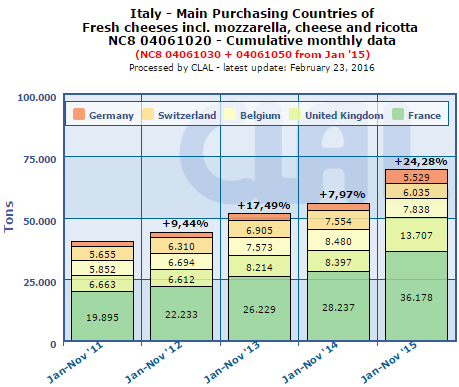

For Fresh cheeses incl. mozzarella, cheese and ricotta:

- France import – accounting for 35% of market share – increased by 28.1%

- United Kingdom import – accounting for 13% of market share – increased by 63.2%

- Belgium import – accounting for 8% of market share – decreased by 7.6%

- Switzerland import – accounting for 6% of market share – decreased by 20.1%

- Germany import – accounting for 5% of market share – increased by 79.3%

For Grana Padano and Parmigiano Reggiano:

- Germany import – accounting for 22% of market share – increased by 3.5%

- USA import – accounting for 16% of market share – increased by 28.3%

- France import – accounting for 9% of market share – increased by 3.6%

- United Kingdom import – accounting for 8% of market share – decreased by 0.6%

- Switzerland import – accounting for 6% of market share – decreased by 5.9%

For Pecorino and Fiore Sardo:

- USA import – accounting for 63% of market share – increased by 5%

- Germany import – accounting for 8% of market share – decreased by 0.2%

- France import – accounting for 7% of market share – increased by 20.4%

- United Kingdom import – accounting for 4% of market share – decreased by 1.2%

- The Netherlands import – accounting for 2% of market share – increased by 26.6%

For Gorgonzola:

- Germany import – accounting for 22% of market share – increased by 9.8%

- France import – accounting for 21% of market share – increased by 4.9%

- Luxembourg import – accounting for 8% of market share – increased by 164.9%

- United Kingdom import – accounting for 5% of market share – increased by 16.5%

- The Netherlands import – accounting for 5% of market share – increased by 0.4%

Italy exports in November 2015 compared to November 2014 increased in volumes for SMP (+212.7%), Cheese (+18.5%) while decreased for Whey Powder (-7.2%).

Export of main cheese in November 2015 compared to November 2014 increased in volumes for Fresh cheeses incl. mozzarella, cheese and ricotta (+32.2%), Grated or powered cheeses (+28.1%), Gorgonzola (+25.1%), Grana Padano and Parmigiano Reggiano (+16.1%), Asiago, Montasio, Ragusano, Caciocavallo (+12.6%), Provolone (+11.1%) while decreased for Pecorino and Fiore Sardo (-22.9%).

|

ITALY: Dairy Trade year-to-date (November)

|

|

|

| |

EXPORT (Ton) |

| 2015 |

± on 2014 |

| Cheese |

331.638 |

+10,1% |

| Whey Powder |

402.203 |

-5,3% |

| SMP |

10.663 |

+85,4% |

| Butter |

8.760 |

+48,0% |

| Lactose Pharm. |

25.501 |

-3,1% |

| Milk in pack. of > 2 L |

18.799 |

-0,2% |

| Milk in pack. of <= 2 L |

20.913 |

+135,9% |

| Other products* |

10.797 |

+17,3% |

| TOTAL EXPORT |

829.275 |

+3,6% |

|

|

|

| |

IMPORT (Ton) |

| 2015 |

± on 2014 |

| Cheese |

466.913 |

-0,5% |

| Milk in pack. of > 2 L |

1.420.670 |

-3,4% |

| Butter |

64.728 |

+9,2% |

| Milk in pack. of <= 2 L |

423.172 |

-5,9% |

| SMP |

73.607 |

+21,3% |

| Whey Powder |

132.666 |

-1,8% |

| Infant milk formula |

43.934 |

+0,8% |

| Other products* |

57.656 |

-4,4% |

| TOTAL IMPORT |

2.683.345 |

-2,4% |

|

* Other products: Infant milk formula, WMP, Condensed Milk, Caseinates, Casein, Lactose edible

Data processed by Clal based on GTIS source.

|

* Other products: WMP, Casein, Condensed Milk, Lactose Pharmaceutical, Caseinates, Lactose edible

Data processed by Clal based on GTIS source.

|

| VALUE (Mio EUR) |

2012 |

2013 |

2014 |

year-to-date (November) |

| 2014 |

2015 |

± on 2014 |

| Export (E) |

2.220 |

2.362 |

2.464 |

2.262 |

2.318 |

+2,5% |

| Import (I) |

3.223 |

3.615 |

3.562 |

3.312 |

2.818 |

-14,9% |

| Balance (E – I) |

-1.004 |

-1.253 |

-1.098 |

-1.050 |

-500 |

-52,3% |

|

|

|

|

|

|

|

Italy: FRESH CHEESES INCL. MOZZARELLA, CHEESE AND RICOTTA EXPORT

Main IMPORTERS of 2015

Period: January-November

|

| Ton |

Share

2015 |

2013 |

2014 |

2015 |

% on

2014 |

| TOTAL |

|

80.592 |

85.329 |

102.973 |

+21% |

| France |

35% |

26.229 |

28.237 |

36.178 |

+28% |

| United Kingdom |

13% |

8.214 |

8.397 |

13.707 |

+63% |

| Belgium |

8% |

7.573 |

8.480 |

7.838 |

-8% |

| Switzerland |

6% |

6.905 |

7.554 |

6.035 |

-20% |

| Germany |

5% |

2.718 |

3.083 |

5.529 |

+79% |

|

|

|

|

|

|

Italy: GRANA PADANO AND PARMIGIANO REGGIANO EXPORT

Main IMPORTERS of 2015

Period: January-November

|

| Ton |

Share

2015 |

2013 |

2014 |

2015 |

% on

2014 |

| TOTAL |

|

71.898 |

73.580 |

78.830 |

+7% |

| Germany |

22% |

16.117 |

16.599 |

17.178 |

+3% |

| USA |

16% |

10.341 |

9.645 |

12.379 |

+28% |

| France |

9% |

6.905 |

6.992 |

7.241 |

+4% |

| United Kingdom |

8% |

5.549 |

6.030 |

5.991 |

-1% |

| Switzerland |

6% |

5.089 |

5.304 |

4.990 |

-6% |

|

|

|

|

|

|

Italy: PECORINO AND FIORE SARDO EXPORT

Main IMPORTERS of 2015

Period: January-November

|

| Ton |

Share

2015 |

2013 |

2014 |

2015 |

% on

2014 |

| TOTAL |

|

15.611 |

15.076 |

15.822 |

+5% |

| USA |

63% |

9.279 |

9.431 |

9.904 |

+5% |

| Germany |

8% |

1.517 |

1.284 |

1.282 |

-0% |

| France |

7% |

963 |

902 |

1.086 |

+20% |

| United Kingdom |

4% |

597 |

643 |

635 |

-1% |

| Netherlands |

2% |

319 |

305 |

386 |

+27% |

|

|

|

|

|

|

Italy: GORGONZOLA EXPORT

Main IMPORTERS of 2015

Period: January-November

|

| Ton |

Share

2015 |

2013 |

2014 |

2015 |

% on

2014 |

| TOTAL |

|

14.606 |

14.846 |

16.862 |

+14% |

| Germany |

22% |

3.408 |

3.452 |

3.789 |

+10% |

| France |

21% |

3.375 |

3.330 |

3.494 |

+5% |

| Luxembourg |

8% |

541 |

487 |

1.291 |

+165% |

| United Kingdom |

5% |

742 |

794 |

925 |

+16% |

| Netherlands |

5% |

825 |

910 |

914 |

+0% |

View Italy’s Import/Export summary on CLAL.it.

Do you need additional information on dairy Import/Export? Subscribe to the Dairy World Trade area on CLAL.it

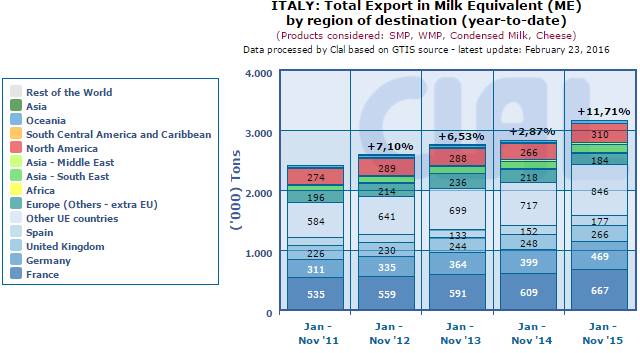

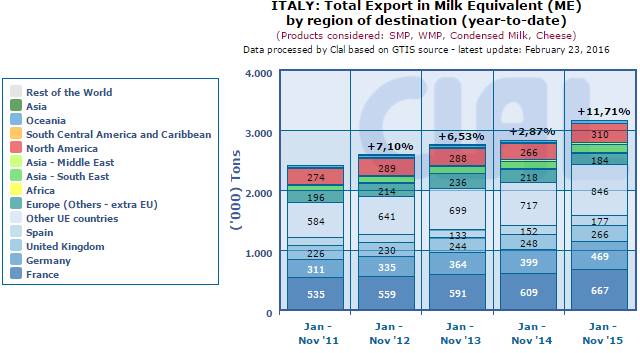

CLAL.it – Italy: Total Export in Milk Equivalent (ME) by region of destination (year-to-date)

CLAL.it – Italy – Main Purchasing Countries of Fresh cheeses incl. mozzarella, cheese and ricotta

... share

... share

Leave a Reply

You must be registered and logged in to post a comment.